LP Forum is a one day meeting on September 10th of 150 Institutional Investors and alternative fund managers from the Nordic region and our surrounding countries.

Attendees include LPs:

Family office leaders, sovereign funds, pension funds, foundations, fund of funds, and high-net-worth individuals.

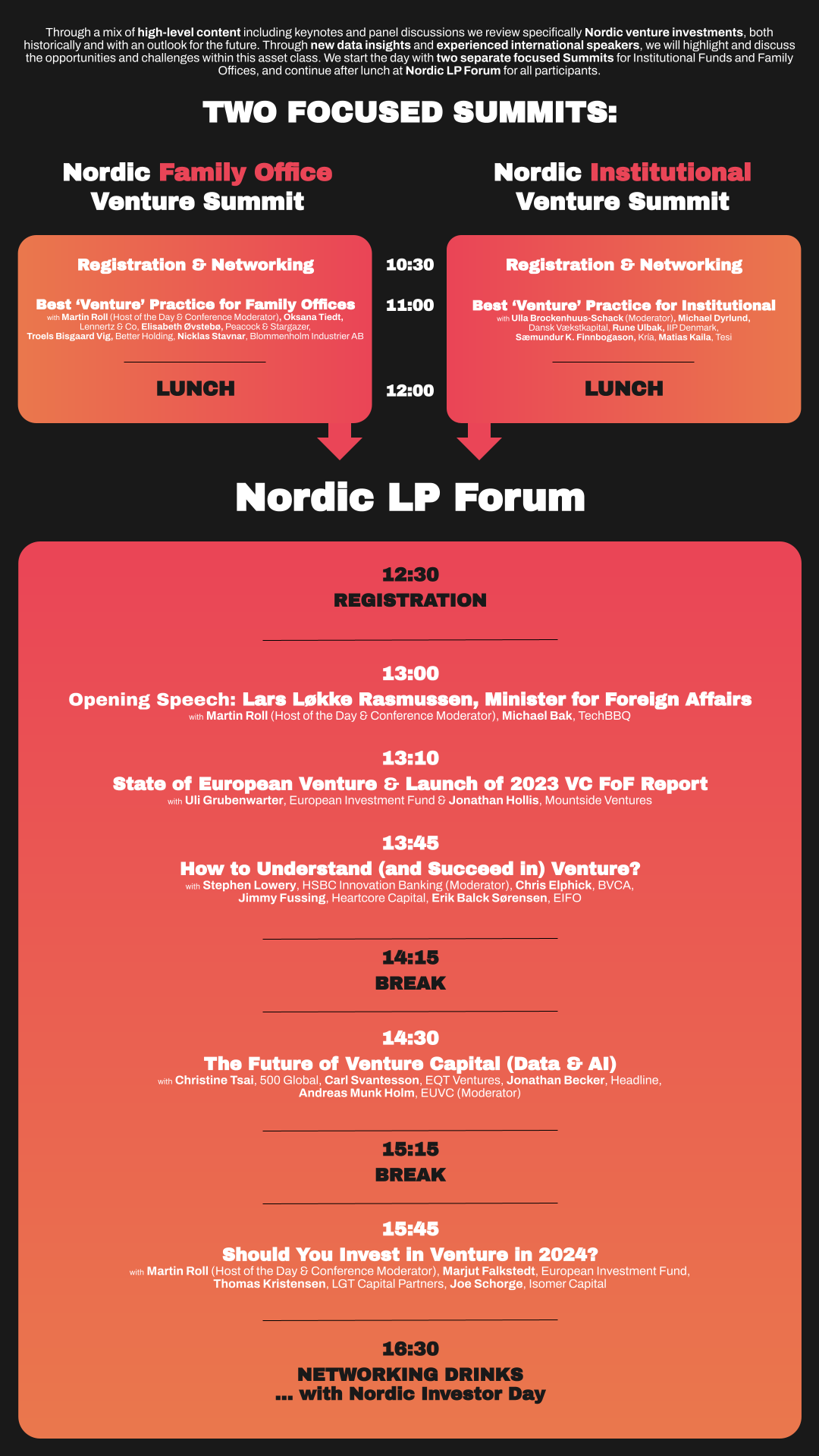

LP Forum 2023

Program Recap

LP Forum 2024 program will be announced soon.

Advisory Board

Matthias

Ummenhofer

Managing Partner

at mojo.capital

Matthias established mojo.capital in Luxembourg in 2014. The venture raised Mojo Digital One, Europe’s pioneering hybrid tech fund, investing in 35 esteemed VC funds and 12 prominent tech firms. He presently holds positions on the Board of Managers and Investment Committee at Bootstrap Europe.

Gudbjorg Edda

Eggertsdottir

Chairman

at Pretium

Gudbjorg has held various executive positions at Actavis Group and predecessors 1980-2014. She is a private investor and serves several boards, including Brunnur VC Fund, Brunnur II. Chairman of the Board and Council of Reykjavik University from 2022.

Erik

Wijnbladh

Director

at Rettig Group

Erik leads the global venture and growth equity investment program at Rettig Group. He has had a diverse career in venture capital, private equity, and leadership positions in IT and energy companies. Erik specialises in constructing and designing venture capital and private equity investment programs.

Thomas

Kristensen

Partner

at LGT Capital Partners

Thomas is responsible for origination, due diligence, execution and monitoring of European private equity investments at LGT Capital Partners, as well as for venture and growth equity investments.

Mark

Johnston

Managing Director at Chr. Augustinus Fabrikker

Mark is responsible for direct private investments and alternatives (LP commitments) at Chr. Augustinus Fabrikker – a subsidiary to Augustinus Foundation with long-term focus. Mark serves on several boards and Investor committees including multiples venture funds in Denmark & Europe.

Become a partner!

LP Forum is a great opportunity to support and engage with the investor community & ecosystem. Please get in touch if you want to learn more about the opportunities to partner with us.